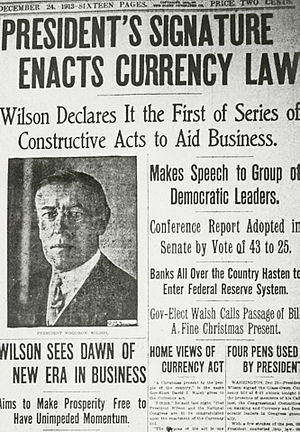

Image via Wikipedia

Image via WikipediaLater, when it became clear information would be disclosed, New York Fed legal group staffer James Bergin e-mailed colleagues saying: “I have to think this train is probably going to leave the station soon and we need to focus our efforts on explaining the story as best we can. There were too many people involved in the deals -- too many counterparties, too many lawyers and advisors, too many people from AIG -- to keep a determined Congress from the information.”

Think of the enormity of that statement. A staffer at a body with little public accountability and that exists to serve bankers is lamenting the inability to keep Congress in the dark. (emphasis added)

This entire economic crisis is a conspiracy led by our banks who in turn are led by our(?) Federal Reserve.

Now, if President Obama is truly "the outsider" that can come in and reform and right the wrongs of our government and truly create "change we can believe in" he would excessive the power we have given him and begin to make some changes - starting with many of the people he has surrounded himself with - the "old guard". Purge the government of those folds that have come from our true enemy - the banks - replacing them with true patriots. Those that are willing to serve to actually "serve" the public for a better America not to "use" the public for a better bank account.

Read David Reilly...click here

Congratulations to the New Orleans Saints

You are a true American story

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=c61aee34-36f2-4fb5-aeb1-92e5ec5f61d7)

I thought HAMP was to help you through difficult situation not create an impossible one?

ReplyDeletefees, fees, and more fees

Hope Stops with AURORA LOAN SERVICES?

Here is a lady who has started a class action suit please get in touch with her. We are having all the same problems. http://www.auroraloanvictims.com/

Read the comments.....they string you along as they take your payments:

http://www.afscanhelp.com/companies/mortgage-companies/aurora-loan-services.cfm

THANKS A LOT OBAMA FOR YOUR SUPPORT OF TIM GEITHNER WHO HAS BEEN SO INSTRUMENTAL IN ROBBING AMERICANS BLIND

ReplyDeleteWhy didn’t Obama fire Tim Geithner long ago? That is a question that a lot of Americans would like to have answered. Geithner has tarnished Obama’s image as much as Obama’s backroom deals in the White House with Pharmaceutical companies. It looks more and more like Obama represents Wall Street and not Main Street and as for a transparent government–well Obama must have misread his teleprompter when he was telling us about his “transparent” government.

http://iflizwerequeen.com/?p=5090

Why don't you prioritize and funnel money into more productive areas that will help reduce our countries health care expenditures versus funding your friends on Wall Street...?oh the lobbyists..what to do?

ReplyDeleteWant to change medicine?

Want to change the cost structure?

Want to help people?

Watch this:

Stem Cell Research on The Oprah Show

www.youtube.com/watch?v=4uAVYsYWfGU

Food Stamps – The Great Recession’s Soup Lines

ReplyDeleteUS food stamps set ever-higher record-32.8 million

http://tinyurl.com/y8ka7sf

Give her a little power..

ReplyDeleteWall Street's Race to the Bottom

Jamie Dimon is wrong. We shouldn't expect a crisis 'every five to seven years.'

Banking is based on trust. The banks get our paychecks and hold our savings; they know where we spend our money and they keep it private. If we don't trust them, the whole system breaks down. Yet for years, Wall Street CEOs have thrown away customer trust like so much worthless trash.

Banks and brokers have sold deceptive mortgages for more than a decade. Financial wizards made billions by packaging and repackaging those loans into securities. And federal regulators played the role of lookout at a bank robbery, holding back anyone who tried to stop the massive looting from middle-class families. When they weren't selling deceptive mortgages, Wall Street invented new credit card tricks and clever overdraft fees.

In October 2008, when all the risks accumulated and the economy went into a tailspin, Wall Street CEOs squandered what little trust was left when they accepted taxpayer bailouts. As the economy stabilized and it seemed like we would change the rules that got us into this crisis—including the rules that let big banks trick their customers for so many years—it looked like things might come out all right.

Now, a year later, President Obama's proposals for reform are bottled up in the Senate. The same Wall Street CEOs who brought the economy to its knees have spent more than a year and hundreds of millions of dollars furiously lobbying Washington to kill the president's proposal for a Consumer Financial Protection Agency (CFPA).

It's a bad calculation because shareholders suffer enormously from the long-term cost of the boom-and- bust cycles that accompany a poorly regulated market. J.P. Morgan CEO Jamie Dimon recently explained this brave new world, saying that crises should be expected "every five to seven years."

He is wrong. New laws that came out of the Great Depression ended 150 years of boom-and-bust cycles and gave us 50 years with virtually no financial meltdowns. The stability ended as we dismantled those laws and failed to replace them with new laws that reflected modern business practices.

With their reputations in tatters, the CEOs have decided to go on the offensive in Washington. They might have had some thoughtful suggestions for how to better shape a consumer agency. Instead, they have unleashed lobbyists who are determined to do anything to kill the consumer agency.

The latest lie is that the CFPA is "big government." The CEOs all know that the current regulatory structure, which they support, is big government at its worst: bureaucratic, unaccountable and ineffective. The CFPA will consolidate seven separate bureaucracies, cut down on paperwork, and promote understandable consumer products. In the process, it will stabilize the industry, rebuild confidence in the securitization market, and leave more money in the pockets of families. Complaining about short, readable contracts and efforts to slim down bureaucracy only further diminishes the banks' credibility.

This generation of Wall Street CEOs could be the ones to forfeit America's trust. When the history of the Great Recession is written, they can be singled out as the bonus babies who were so short-sighted that they put the economy at risk and contributed to the destruction of their own companies. Or they can acknowledge how Americans' trust has been lost and take the first steps to earn it back.

Ms. Warren is a law professor at Harvard and is currently the chair of the TARP Congressional Oversight Panel.

http://online.wsj.com/article/SB10001424052748703630404575053514188773400.html

Better for who?

ReplyDeleteSummers, Geithner, you?

Banking and Housing Payments Devoured the Middle Class Income – 1 out of 10 Americans on Food Stamps and how the Fed Slowly Devalued the Dollars in your Wallet.

It is a challenge to say that things are getting better when every month that goes by more Americans are losing their jobs or needing to apply for food assistance. In the latest data for food assistance through SNAP we find that 200,000 more Americans were added to the program. That now brings the total number of Americans on food assistance to 38,183,000. 1 out of 10 Americans are receiving food assistance. For 2009 this cost the government $50 billion, up from $34 billion in 2008 and $30 billion in 2007. It should be no surprise then that average Americans are questioning the viability of a middle class in the upcoming decade.

http://tinyurl.com/ybqufoe

This is out of control...

ReplyDeleteListen to this..Obama's team doesn't want you to get a modification:

The Indymac Slap in our Face. 02.08.10

http://www.thinkbigworksmall.com/mypage/player/tbws/23088/1540466